What Is Suilend’s Endgame ?

Suilend showed up with the one ecosystem to fix them: liquidity fragmentation, multi-app UX issues, LST depegging problem and Too-Good-to-Be-True Yields while keeping the community engaged.

After launching the SpringSui standard for LSTs, Suilend announced Steamm, a capital-efficient AMM that lends idle assets for additional yield. Now that Suilend has a fully stacked DeFi suite, what’s the endgame?

The Suilend Story

The Suilend ecosystem started with Suilend itself, a lending and borrowing platform with the best UX DeFi had seen, multi-asset support, competitive rates, and built-in bridging and swap support.

It was the first platform on which users could access the complete DeFi suite, with full-on composability features like one-click swap and deposit and wholesome insights for user account management.

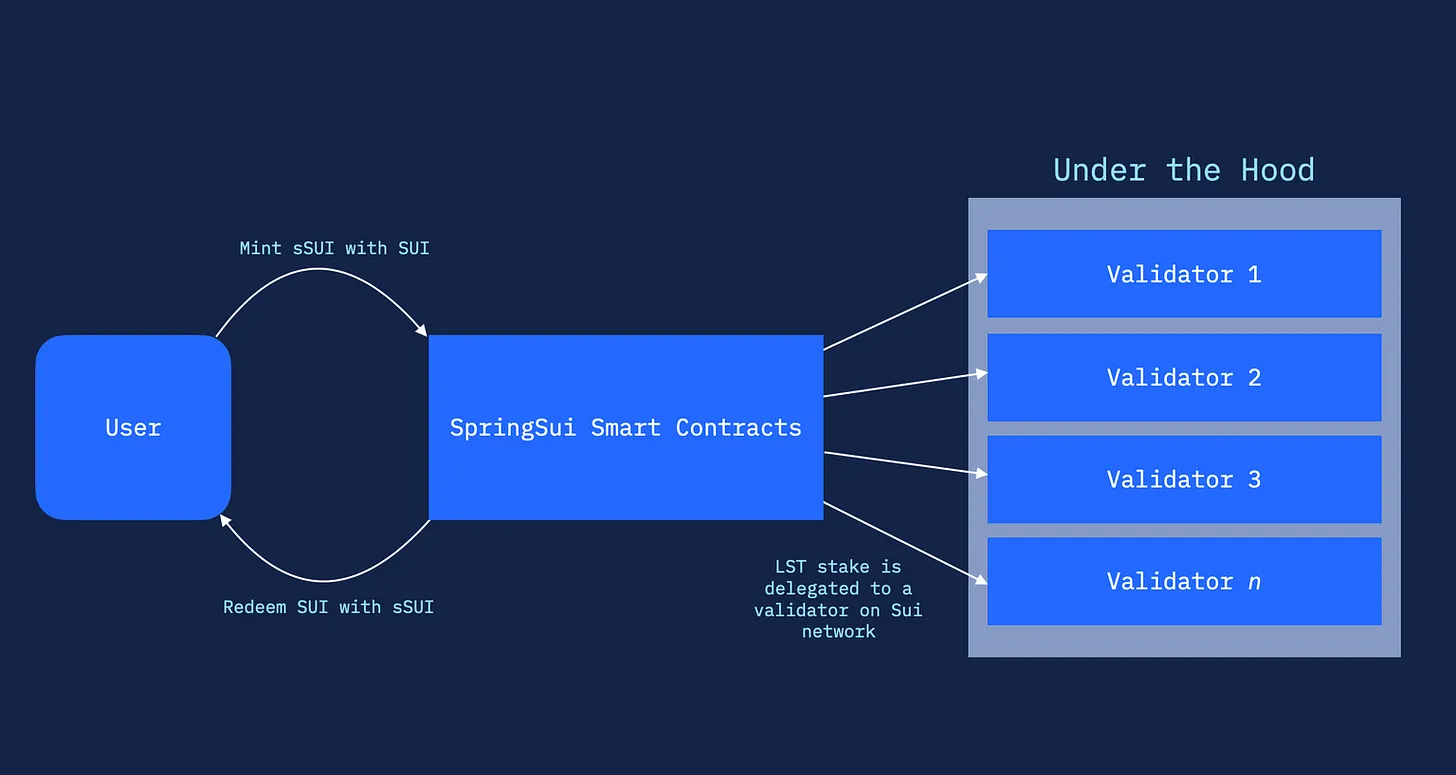

The following product from the Suilend team was SpringSui: an LST standard similar to Sanctum on Solana with the LST depegging solved based on SIPs (Sui Improvement proposals) 31.

SpringSui allows anyone to create LSTs that are fully fungible and backed by staked Sui coins. Users can easily unstake the LSTs, which are interoperable within Sui’s DeFi ecosystem.

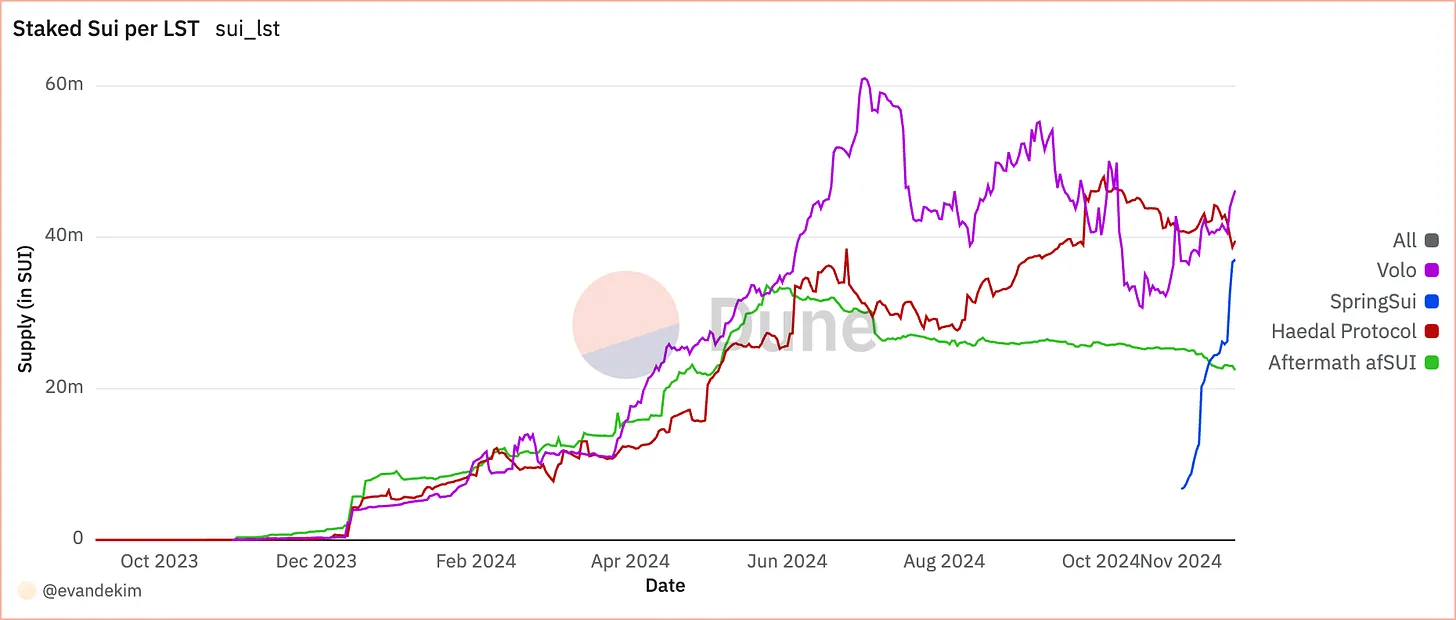

SpringSui has become the fastest-growing LST on and off Sui after clinching the $130m TVL mark in 23 days. Over 30m+ Sui are staked across the sSui, mSui, and fudSui products.

Staked Sui per LST. Source: Sui Liquid Staking on Dune

Staked Sui per LST. Source: Sui Liquid Staking on Dune

Off the $130m TVL on SpringSui, $128m went to the Suilend protocol, where users earn a higher yield than they would deposit Sui. Suilend also announced the 1-click staking and depositing of all the assets on SpringSui into Suilend, another UX masterclass that tightly knits the ecosystem.

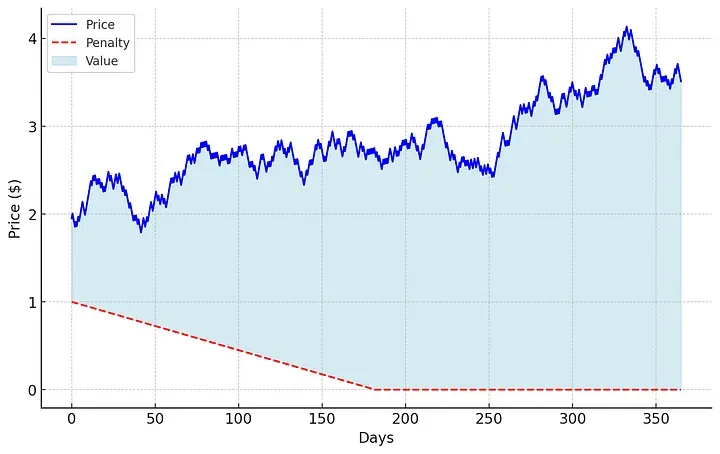

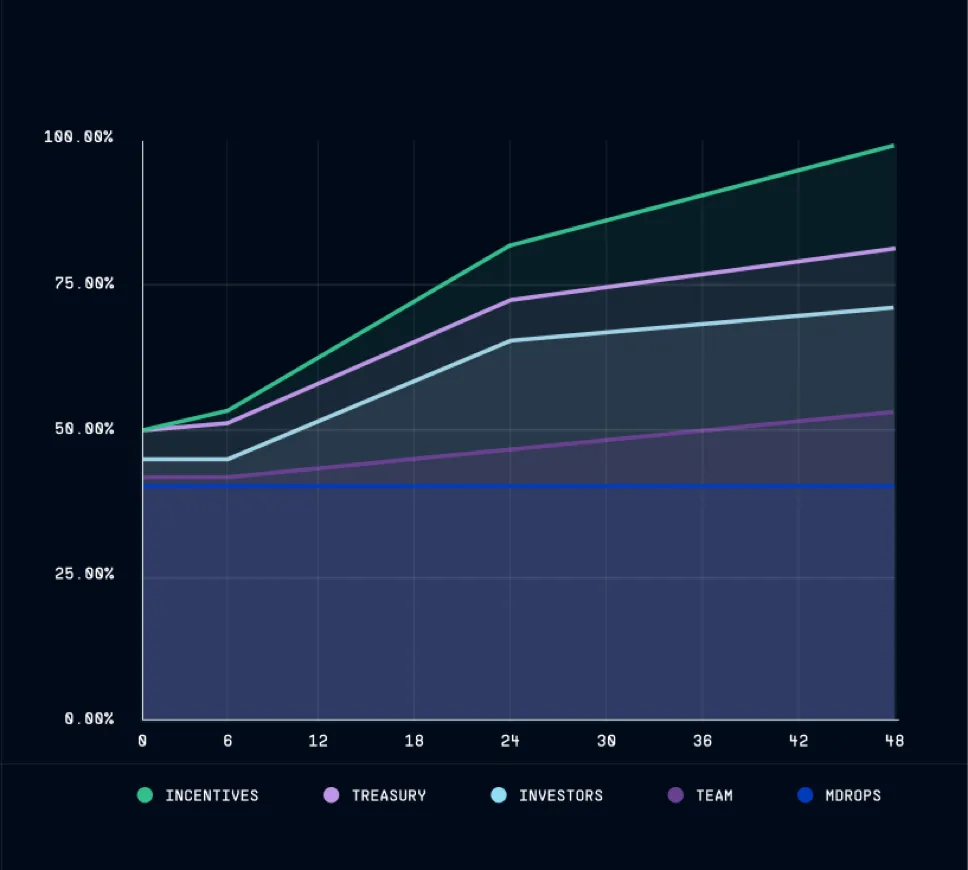

Suilend is launching a token with the ticker $SEND to decentralise its product ecosystem. The $SEND token will be the governance token for Suilend, SpringSui, and Steamm. It will have an airdrop for loyal users via a supply inflation mechanism tagged MDROPS (maturing airdrops) that rewards users who hold their tokens.

MDROPs will help balance issuing a high initial float and the risk of overwhelming sell pressure by allowing users to claim all their airdrops WITHOUT VESTING. Still, they must pay a penalty if they choose to claim before the maturing period (3 Months from TGE).

The final piece of the Suilend Sui DeFi suite is the icing on the cake: the Steamm DEX. By lending idle assets, Suilend will provide competitive rates to lenders, attract more deposits, and grow the pie for both Suilend and the Sui network.

It’s a dangerous endgame for competing DeFi apps and networks on launch. How?

What Is the Suilend Endgame

Capital efficiency on deposits is just one of the benefits Suilend is set to achieve with its DeFi suite; they’re about to take the DeFi mantle so that Sui can compete with the external DeFi apps in terms of TVL.

Of course, borrower APRs should stay low, and deposit APRs would increase based on returns from the AMM, but that’s not all. There’d be a chain of network effects that you need to pay attention to.

Suilend Becomes a DeFi Super App

Suilend’s swap and bridge integration, which launched in the early stages, has already allowed users to do everything right in one place. Still, there were no interoperations or added benefits for users, plus the fact that using Hop and Aftermath’s aggregators only shifted risk that could affect Suilend users.

With a native AMM, Suilend will provide better APRs, and users can build more complex strategies across the ecosystem with less slippage and dynamic fee structures optimized for users and the protocol.

Sticky Liquidity Flywheel

Integrating the three products will make Suilend a liquidity hub that runs capital efficiently and is the most efficient system on Sui. The protocol would attract liquidity and retain it through a self-reinforcing cycle that benefits users and the platform.

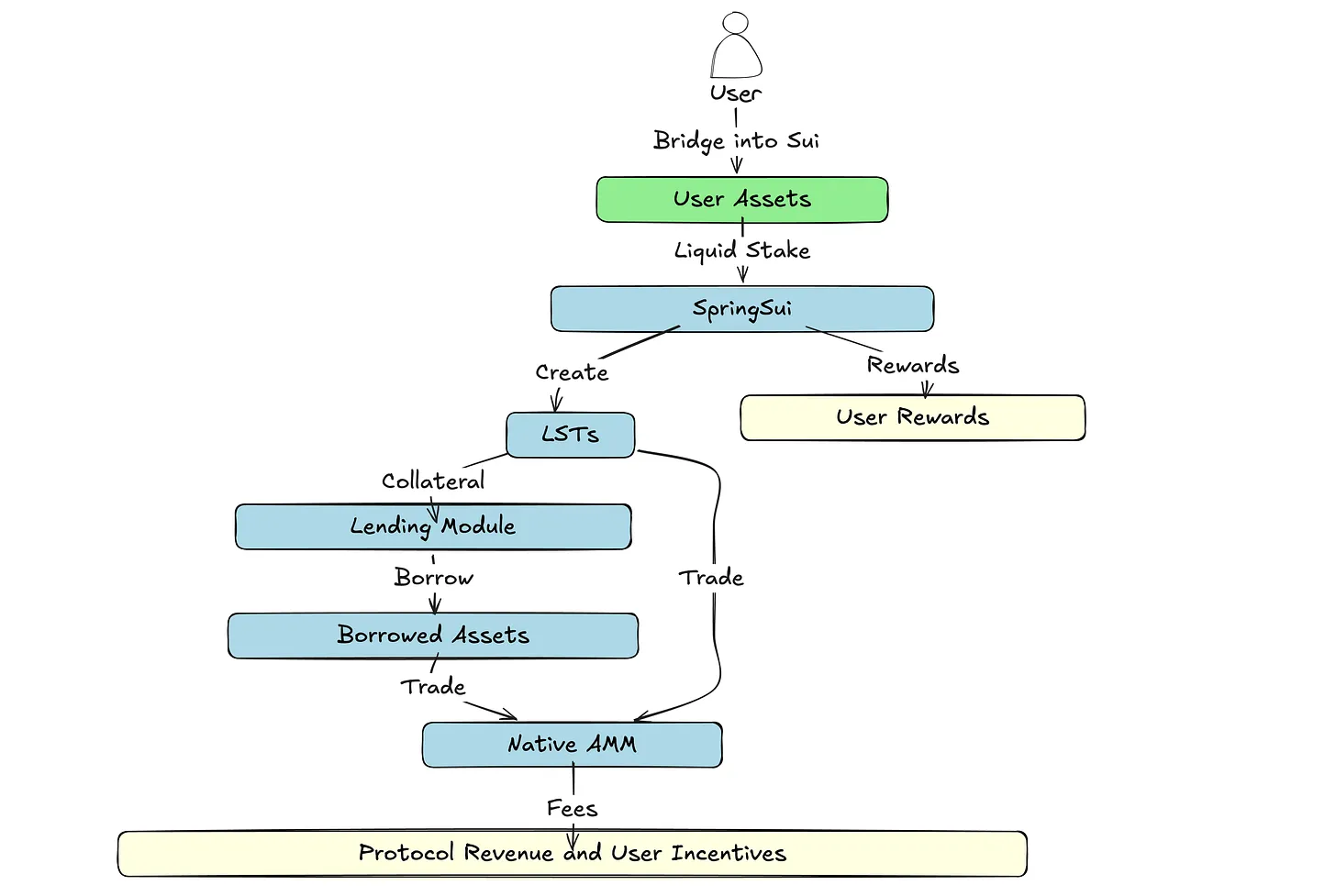

The flywheel begins with liquidity onboarding; after staking Sui for one of the LSTs running on the SpringSui standard, users can deposit liquidity on the AMM or lending platform for yield or trade to access other tokens in the Sui ecosystem.

Steamm would be a trading and liquidity engine for users to direct their LSTs and borrowed assets. We might see LP tokens fly as collateral, the first DeFi perpetual motion machine with tight composable integrations.

Holy $SEND Tokens

One token for governance across three products is a fantastic demand driver that puts a lot of value on the $SEND token.

On TGE, Suilend is Controlling supply inflation through the MDROP mechanism. It balances token distribution and market dynamics with a high float and underwhelming sell pressure, allowing the community to stay vested and engaged through the early stages.

The token would also see consistent demand since it will power interactions and rewards within Suilend’s DeFi suite and maybe accrue value through transaction fees, protocol revenues, and strategic buy-backs or deflationary mechanisms,

Conclusion

Suilend is building and shipping products with product market fit and integrating them to work seamlessly to improve its users' experience drastically. The UX will keep users when Steamm launches; the capital efficiency will make Suilend the most capital-efficient ecosystem in crypto.